- Cyrus Ventures Radar

- Posts

- Cyrus Ventures Radar - September 2025

Cyrus Ventures Radar - September 2025

Nuclear Deals Exceed $100B, Anduril Wins $354M in Contracts, Defense Production Scales, AI Infrastructure Crisis Deepens.

September 2025 Edition

Welcome to the September edition of Cyrus Ventures Radar. This month marks an inflection point as nuclear energy deals exceed $100B globally. Arbor Energy advanced partnerships with industry giants and prospective customers, Icarus began generating revenue and is on track for more before year end, and our newest investment in Antares Nuclear positions us at the epicenter of the SMR revolution. The convergence of AI compute demands and production scaling confirms what we’ve known all along: infrastructure determines winners.

Portfolio Spotlight

Cyrus is proud to support transformative companies building the physical backbone of American dominance:

Arbor Energy: Deepening strategic relationships with multiple industry giants including prospective customers who are actively exploring their clean gas turbine technology. The company continues to field inquiries from energy primes seeking alternatives to the 5+ year backlogs plaguing incumbents. With these partnerships advancing, Arbor remains positioned for a transformative announcement that could reshape the competitive landscape.

Icarus: The company has begun generating revenue and is on track to close on even more before year end. Their stratospheric platform continues opening doors in both defense and telecom sectors, and the company is on track to make a big announcement within the next few weeks. The revenue traction validates market demand for persistent high-altitude capabilities as they ship out their first birds to DoD customers.

Volund Manufacturing: The company is in conversations with prospective customers while bringing parts of their new Redondo Beach facility online. Their automated manufacturing systems for attritable gas turbines has piqued the interest of several large players engaging the company in private conversations. Attritable systems have proven to be a critical production bottleneck that Volund is proving themselves capable of solving.

Volund Manufacturing Testing their Demo Engine

Investment Opportunities & Updates

We’ve secured strategic access to several transformative opportunities while our existing investments continue their momentum:

New Strategic Positions:

Antares Nuclear: Recently closed our investment as the company finalizes their Series B raise, which was oversubscribed with demand for their government-centric approach to micro SMRs. Their selection for DOE’s Reactor Pilot Program and HALEU fuel allocation positions them to achieve criticality by 2026. We are further proud to back a company with Cyrus Advisor Neil Mason at the helm of the engineering team.

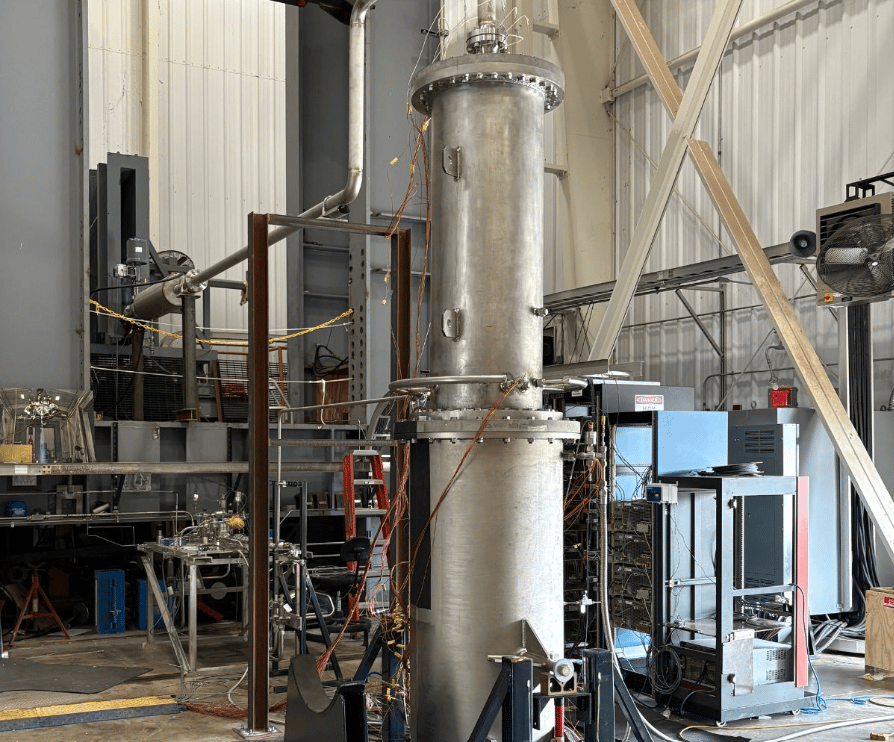

Antares Nuclear’s Electrically Heated Test Rig

Recent Investment Traction:

Anduril Industries: Secured $350M+ in new contracts including ~$160M for the Soldier Borne Mission Command program with Meta, positioning them at the center of human-machine teaming. Construction at their 5 million square foot Ohio Arsenal-1 facility continues on schedule, representing the largest job creation project in Ohio history.

First Deliveries of Anduril’s Ghost Shark XL to the Australian Navy

Chaos Inc.: Following successful Middle East deployments, the company is continuing testing on their Astria counter-drone systems at Eglin Air Force Base. Their field-proven technology positions them perfectly as they continue to eat away at the growing counter drone market.

Impulse Space: Impulse announced their Anduril partnership for GEO rendezvous operations and unveiled same-day orbital delivery capabilities. Their Helios kick stage officially can deliver payloads to GEO in under 24 hours versus months for traditional systems.

Stoke Space: Stoke’s Cape Canaveral Launch Complex 14 continues to show rapid progress with flame diverters installed and integration hangars nearing completion. Their selection for the $5.6B NSSL Phase 3 program validates the immense demand for a fully reusable architecture as essential for future launch cadence requirements.

Stoke’s Zenith Rocket Test Fire at Moses Lake Facility

Team & Strategy

The Cyrus team's expertise and networks proved invaluable in evaluating nuclear opportunities and understanding the true demand convergence of AI compute and defense production. Their relationships opened doors to oversubscribed rounds while their technical insights helped identify which companies can actually deliver on their ambitious promises leading to our investment in Antares Nuclear.

I’ll be attending numerous happy hours, conferences, and dinners during LA’s Deep Tech Week in October. If you’re interested in meeting during that time, please reach out. Additionally, I’ll be attending the Payload Space Conference in November, continuing to build the relationships that give our portfolio companies unfair advantages.

Cyrus Team Dinner Action Shot Courtesy of Neil Mason’s Photography

Market Insights

September’s developments continued to validate our thesis that infrastructure, not algorithms will determine winners.

US-UK Nuclear Partnership Unlocks $100B for AI Power: The Atlantic Partnership for Advanced Nuclear Energy represents the largest transatlantic nuclear cooperation since the 1950s. Centerpiece deals include Centrica’s agreement for 12 X-energy reactors (960 MW) and Holtec’s $15B SMR development.

12x Increase from 2023 Baseline

Pentagon Adopts VC-Style Acquisition at Scale: The Army’s $750M annual FUZE program launches with former VC executive Daniel Driscoll driving “spiralized development” replacing 20-year linear programs. Combined with Replicator delivering hundreds of autonomous systems with 75% from non-traditional contractors, the defense acquisition revolution has made a big step forward.

On track to approach record levels with Q4 still ahead

AI Infrastructure Crisis Forces Trillion-Dollar Realignment: Nvidia’s $100B partnership with OpenAI for 10 gigawatts of datacenter capacity reveals AI’s fundamental constraint: power, not compute. September’s $200B+ in datacenter announcements confirms that infrastructure determines competitive advantage as Virginia faces potential 100-fold increase in blackouts by 2030.

Defense Production Renaissance: Europe targets 2 million artillery shells annually by year-end while Anduril breaks the 50-year solid rocket motor duopoly. With the Pentagon identifying 200,000+ suppliers lacking visibility into foreign dependencies, reshoring production becomes a national security imperative creating unprecedented opportunities.

Until Next Time

The September inflection point confirms what we’ve been building toward: the convergence of AI compute demands and defense production scaling creates a generational investment opportunity. Modern entrepreneurs are building the picks and shovels for the next American empire and we’re here to do our part. Arbor’s power generation, Volund’s manufacturing automation, Antares’ micro reactors, and our other positions in proven winners position us perfectly for the infrastructure race ahead.

If you’re planning to visit Los Angeles this fall or attending any Deep Tech Week events, I’d love to meet up. The best deals still come from relationships built on trust, and there's no substitute for meeting face-to-face.

Regards,

Jordan Yashari

Founder & General Partner

Cyrus Ventures

Industrial Empire: The Automated Factory Revolution