- Cyrus Ventures Radar

- Posts

- Cyrus Ventures Radar - October 2025

Cyrus Ventures Radar - October 2025

Arbor Energy $55M Series A, Antares Nuclear’s DOE Pilot Selection, Defense Manufacturing Expands 6M Square Feet

October 2025 Edition

Welcome to the October edition of Cyrus Ventures Radar. This month delivered extraordinary validation as Cyrus portfolio companies secured over $100M in combined funding while the Pentagon launched the Army Janus Program for military microreactors. Arbor Energy’s strategic pivot to fuel-flexible turbines, Antares Nuclear’s DOE Pilot selection, and Icarus joining Y Combinator demonstrate our portfolio’s strategic positioning at the intersection of AI power demands and defense modernization. The infrastructure race isn’t coming, it’s already here, and we’re helping build its foundation.

Portfolio Spotlight

Cyrus is proud to support transformative companies building the physical backbone of American dominance:

Arbor Energy: Closed a $55M Series A co-led by Lowercarbon Capital and Voyager Ventures with participation from Marathon Petroleum Corporation. The company announced their system will be fuel-flexible, capable of utilizing both biomass and natural gas with nearly no emissions, directly addressing AI’s explosive power demands. Their pilot is expected to turn on in December with commercial deployment targeted for 2028.

Icarus: Joined Y Combinator’s Fall 2025 batch, gaining access to the world’s premier accelerator network ahead of December’s Demo Day. The company continues generating strong revenue while testing their vehicles in the stratosphere.

Henry Kwan (Icarus CEO) Winning the Product Showcase for Y Combinator’s Fall Class

Volund Manufacturing: CEO Eric Hostetler delivered a keynote at the Hudson Institute revealing a 7,000 unit turbojet market deficit for 2026 alone. The company’s manufacturing approach addresses core bottlenecks limiting the U.S. stockpile expansion. The team is actively hiring a Founding Turbomachinery Engineer so if you’re interested reach out!

Eric Hostetler (Volund CEO) Showcasing his New Equipment

Investment Opportunities & Updates

We’ve secured strategic access to several transformative opportunities while our existing investments continue their momentum:

New Strategic Positions:

Hemispheric AI: We finalized our allocation in a breakthrough non-invasive brain-computer interface company. The team includes exited founders who previously co-created FaceID (sold to Apple) and CEO Hagai Lalazar who is a PhD in Computational Neuroscience. The system has compelling applications ranging from identification to healthcare, defense, and more.

Recent Investment Traction:

Anduril Industries: Unveiled EagleEye AI headsets at AUSA securing ~$160M Army contract while announcing partnerships with Meta, General Dynamics, and Poland’s PGZ. Palmer Luckey confirmed IPO plans as the company sits at a $30B+ valuation.

Antares Nuclear: Antares filed a notice for nearly $80M in additional funding while securing a selection for the DOE Nuclear Reactor Pilot Program. With first critical demonstration targeted for July 2026 and military deployments by 2028, they’re leading the charge in deployable nuclear power. The Cyrus team celebrated these milestones with the Antares team over lunch on Halloween!

Cyrus Team Treats Antares Team to Kabob on Halloween to Celebrate our Investment

Chaos Inc.: Announced a partnership with Forterra to integrate their VANQUISH distributed radar with autonomous vehicles, with demonstrations scheduled for Army xTech Program.

Impulse Space: Continues operations with Mira missions and Helios stage development targeting a late 2026 debut. The company is continuing to expand on their 30+ signed contracts as their pipeline swells.

Impulse’s Mira Vehicle Getting Ready for Launch

Stoke Space: Stoke Space announced their latest $510M round led by U.S. Innovative Technology Fund bringing the company’s total funding to over $900M. The capital will accelerate their fully reusable Nova rocket development and Launch Complex 14 development at Cape Canaveral.

Stoke Space Completes Stage 2 of Structural Qualification for their Nova Rocket

Team & Strategy

October reinforced that relationships deliver more than just pure capital. Our portfolio companies secured not just funding but critical government program positions and strategic partnerships that can transform their already impressive trajectories. The infrastructure thesis continues to gain validation as AI’s power appetite, defense modernization urgency, and nuclear renaissance continues to converge with companies like Antares Nuclear.

Looking ahead, I’ll be attending the Payload Space Conference November 5th-6th, continuing to identify opportunities where infrastructure bottlenecks create venture-scale opportunities.

Market Insights

October’s market movements validated every aspect of our thesis as defense contracts and nuclear commitments reached unprecedented scales.

Manufacturing Renaissance Addresses Critical Defense Bottlenecks: Volund CEO Eric Hostetler discussed a 7,000 unit turbojet deficit for 2026 alone, while only 8-9 U.S. foundries can produce aerospace-grade castings. Expansion continues to accelerate as AS Aerospace’s 90k sqft Palmdale facility, Anduril’s 5M sqft Ohio Arsenal, and the Army’s distributed Skyfoundry network are targeting tens of thousands of units annually.

Six million square feet coming online in an attempt to address the growing deficit

Golden Dome Creates Multi-Hundred Billion Dollar Missile Defense Market: The Pentagon secured $24.5B initial funding for space based interceptors with testing by 2028 and costs estimates have been updated to range from $160B to $3.6T over the next 20 years. Near-term competition has intensified as Voyager acquired ExoTerra for propulsion systems and Lockheed targeting 2028 on-orbit demonstrations.

Army Janus Program Accelerates Military Nuclear Deployment: The October 14th announcement targets operational microreactors at nine installations by September 2028, with Antares Nuclear selected alongside other competitors in the running for 3-10 MW deployments. The program’s NASA COTS style milestone payments and $2-5B procurement opportunity will transform nuclear from concept to reality.

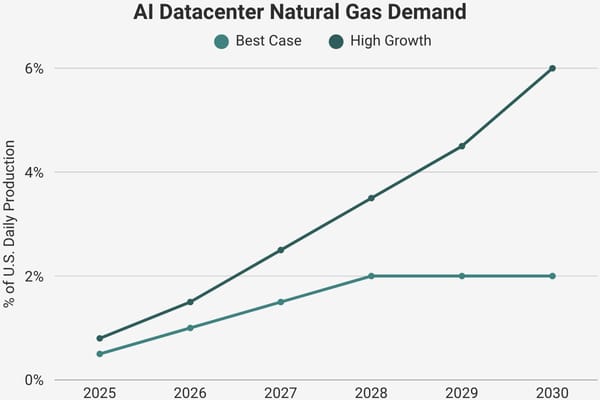

Natural Gas Bridges the AI Power Gap: AI datacenters will need only 2-6% of U.S. daily natural gas production by 2030, easily accommodated by existing infrastructure while grid connections require 5-7 year waits. This reality drove Marathon Petroleum’s strategic investment in Arbor and explains Chevron & GE’s 4 GW partnership. Natural gas with carbon capture is one of the only solutions that can scale within AI’s timeline.

AI needs just 6% of natural gas capacity by 2030

Until Next Time

October’s extraordinary momentum, from massive funding rounds to flagship government programs, demonstrates that infrastructure truly determines destiny. While others debate whether AI, defense, or energy represents the best opportunity, we’re backing the picks and shovels of all three.

Our value beyond dollars approach continues generating trust and access that transforms promising technologies into category defining companies, after all, who doesn’t want a fresh Persian lunch for the whole team? The best investments aren’t just about superior technology, it’s also about backing teams that partners want to work with and governments want to trust.

The best deals still come from relationships built on trust, and there's no substitute for meeting face-to-face, so reach out if your team also wants to discuss the future over a plate of kabob.

Regards,

Jordan Yashari

Founder & General Partner

Cyrus Ventures

Automated Infrastructure Defines Tomorrow