- Cyrus Ventures Radar

- Posts

- Cyrus Ventures Radar - January 2026

Cyrus Ventures Radar - January 2026

$1.5T Defense Budget Proposed, Antares Gets DOE Approval, Critical Loop Joins Portfolio

January 2026 Edition

Is it still ok to say Happy New Year?

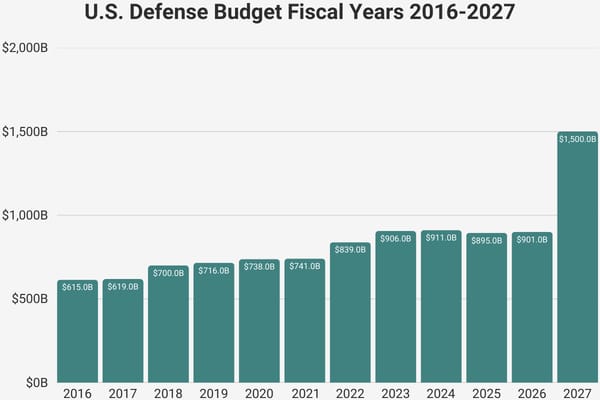

This month has already felt like 12 with everything that’s happened thus far. 2026 is off to a hot start. President Trump proposed a $1.5T defense budget for FY 2027, which would mean a 66% increase that would reshape the American industrial base. Iran tensions have escalated with carrier strike groups deployed and “fingers on triggers” rhetoric from both sides. Meta locked in 6.6GW of nuclear capacity in a single week, and the Cyrus portfolio companies continue crushing milestones against this backdrop.

This month Antares Nuclear received DOE safety approval for July, a major milestone towards reaching criticality, and Anduril’s Arsenal-1 factory confirmed Q2 production targets as construction progresses in Ohio.

On a personal note, I started writing down my perspectives on investing for anyone curious as to how I think about the opportunities I see. Check out Investing in Organized Chaos if you’re interested in some longer form thoughts on how deploy capital.

Portfolio Spotlight

Cyrus is proud to support transformative companies building the physical backbone of American dominance:

Arbor Energy: The ATLAS 1MW pilot system is pushing through its final commissioning stages, and the team is executing on pre-ignition protocols ahead of their first fire. The company is planning to allow site visits to the test facility to watch demonstrations happen in real time.

Icarus: Since winning Y Combinator’s Fall 2025 Product Showcase in December, Icarus has maintained momentum building on its growing government revenue base. The DoD’s $1B “Drone Dominance” initiative targeting 340,000 units by 2027 creates significant tailwinds for persistent ISR (intelligence, surveillance, reconnaissance) platforms.

Volund Manufacturing: The Redondo Beach facility continues running qualification batches for defense prime contractors. Volund is on track to close several LOIs early in Q1 2026. Investors interested in the company’s progress feel free to reach out about an upcoming open house at their facility.

Volund’s Demonstrator Throttle

Investment Opportunities & Updates

Our SPV positions continue to demonstrate significant momentum:

Anduril Industries: Arsenal-1 is taking shape. One year after site selection near Columbus, Ohio, Anduril confirmed construction is progressing at “software speed.” The facility will produce the “Fury” autonomous fighter for the Air Force’s CCA program, with production slated for Q2 2026. The company also received a $10M Space Force boost-phase interceptor prototype contract (say that ten times fast) and announced a Boeing partnership for the Army’s IFPC Increment 2 interceptor program.

A glimpse at the progress of Arsenal-1

Antares Nuclear: On January 26, the DOE approved Antares’ Preliminary Documented Safety Analysis for Mark-0, their demonstration reactor. They’re on track to achieve criticality before July 4, 2026, and if successful will become the first nuclear startup this century to bring a reactor critical. CEO Jordan Bramble described this as “the most significant milestone of the entire process” as they aim to make history.

The Antares team working on their heat pipes

Chaos Inc.: Following their G-TEAD Marketplace selection in December after their work in Germany, Chaos is now positioned for rapid Army procurement of their VANQUISH distributed radar systems. The company is continuing to support the Army’s experimentation with on-site training and rapid product iterations based on their feedback.

Critical Loop: Our latest investment is into a company delivering mobile power to energy constrained sites. Founded by CEO Bala Ramamurthy (ex. SpaceX), the company’s UL-certified power control system addresses the 2,000+ GW stuck in interconnection queues. Their mobile battery solutions mean that hyperscalers and customers now have a path to power capacity while waiting for the ever slow long-term infrastructure to catch up.

Hemispheric AI: CEO Hagai Lalazar was featured in Forbes this past December, outlining the company’s decoding first approach to non-invasive brain computer interfaces. Further details on the company are slated to be announced this year with applications spanning defense, healthcare, and human machine teaming.

Impulse Space: Ending out the year Impulse executed a successful autonomous rendezvous during the LEO Express-2 mission. In layman’s terms, this was an an industry first and they did it all using only a lightweight camera and some closed-loop software. The company’s lunar cargo architecture is slated to expand to offer 3-ton payload delivery by 2028.

Impulse’s Mira Vehicle

Stoke Space: The company’s Nova rocket development is progressing smoothly with a successful FTS test in January and ongoing testing of their Zenith engine at Moses Lake. Their Cape Canaveral Launch Complex 14 construction remains on schedule for use in early 2026. Their first launch is targeted before the end of the year which would unlock competition for $5.6B in NSSL Phase 3 contracts.

Market Insights

$1.5 Trillion Defense Budget Proposed: On January 7th, President Trump announced a proposed FY2027 defense budget of $1.5T, a 66% increase over the FY2026 target of $901B. While numerous budget analysts question the feasibility, the signal is clear: defense spending is accelerating, with autonomous systems, counter drone systems, and missile defense as priorities.

FY 2027 reflects the impact of the Trump administration’s proposal

Iran Tensions Escalate: The USS Abraham Lincoln carrier strike group deployed to the Middle East as Trump warned “time is running out” for a nuclear deal. Iran responded that forces are prepared “with their fingers on the trigger.” The 2026 National Defense Strategy acknowledges Iran is rebuilding conventional forces, expanding addressable markets for missile defense and counter drone systems, amongst ongoing political turmoil.

Hyperscaler Nuclear Deals Accelerate: Meta announced agreements with Vistra, Oklo, and TerraPower to procure up to 6.6GW of nuclear capacity by 2035, the sector’s largest deal to date. With U.S. data center demand reaching 75.8GW in 2026 (up 22%) and 2,000+ GW stuck in interconnection queues, distributed generation solutions and off the grid solutions are becoming increasingly strategic.

Until Next Time

The convergence we’ve been tracking is no longer a thesis, it’s consensus. The $1.5 trillion budget proposal, Meta’s 6.6GW nuclear commitment, and Golden Dome’s $151 billion contract vehicle all point to the same conclusion, infrastructure will determine the winner.

Thank you for your continued support, here’s to a strong 2026.

Regards,

Jordan Yashari

Founder & General Partner

Cyrus Ventures

Powering the Future